API for E-VAT INTEGRATION DOCUMENTATION

E-VAT is an electronic means of issuing VAT receipts OR an electronic invoicing system for VAT-registered businesses. E-VAT is not a new tax, but an improvement on how VAT transactions are invoiced.

The Ghanaian Revenue Authority (GRA) has announced that phase 2 of its e-invoicing system, known as “E-VAT,” will begin in December 2023. With 600 taxpayers, Phase 1 began in 2022 and is scheduled to end in June 2023. These taxpayers are sizable and high-risk.

The GRA has already launched a digital services portal and e-commerce platform that let residents and non-residents alike pay taxes online.

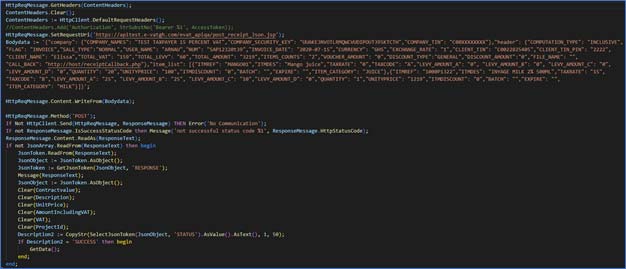

Sending POST Request to API : https://apitest.e-vatgh.com/evat_apiqa/ post_receipt_Json.jsp

Variables for Post Data

Get Data Method

Response from API : https://apitest.e-vatgh.com/evat_apiqa/get_Response_JSON.jsp

Now in QRCodeURL Variable we have received response from Post method which is URL and through which we needs to create a RDLC report which will print QR Code from given URL. That we can see in below screenshot.

Once we scan this printed QR Code then we will be redirected to URL. As we can see in the screenshot below.